Prendio Tax & Freight Assignment Options Explained

Updated on April 29, 2025

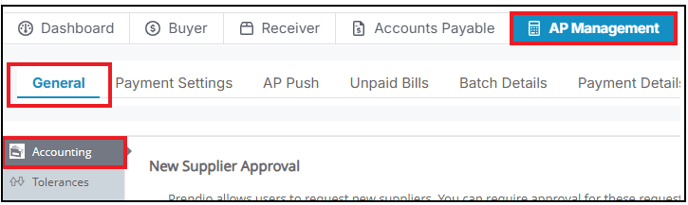

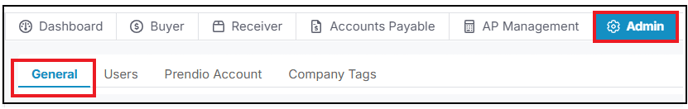

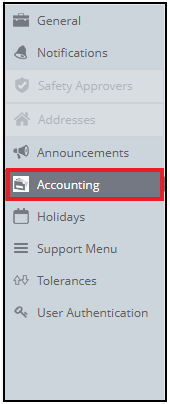

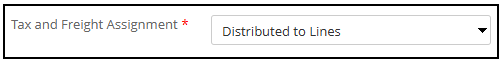

Prendio offers two different ways for the Tax and Freight expenses to be pushed to an ERP System. How these expenses are handled is controlled by the Tax and Freight Assignment setting found in the Accounts Payable, AP Management, or Admin roles. The options are Distributed to Lines and Specific Accounts.

Please note that Tax and Freight Assignment will not be available for companies that are not integrated with an ERP system.

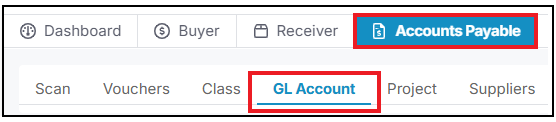

Locate the Accounts Payable role followed by GL Account:

Below the table of GL Accounts will be the Tax and Freight Assignment. Distributed to Lines is the Default setting. With this setting the Tax and Freight expenses will be combined and then distributed evenly among the line items on the Invoice.

Example: If these expenses totaled $50.00 and there were 5 Line Items on the Invoice, $10.00 would be added to each Line Item:

Users can also opt to select Specific Accounts to allow these expenses to be charged to individual GL Accounts:

When Specific Accounts is selected as the Tax and Freight Assignment, additional dropdown menus are available under Reserved Accounts. Users can select a GL Account for Tax and a separate/or the same GL Account for Freight for these expenses to be charged to:

The GL accounts available to select are based on what has been synced from the ERP and available in the GL Accounts > ERP GL Account table:

When bills are pushed to an ERP system, the resulting ERP bills will have a separate line for Tax and a separate line for Freight.

Save any changes:

![]()