Payments FAQ

Updated on August 8, 2025

Payments allows companies to streamline the purchase of merchandise and services to the payment of a supplier all within Prendio. Below are some frequently asked questions regarding payments. Details will be updated as new enhancements for Payments are implemented.

Payments Setup During Onboarding

Payments Setup During Onboarding

What are the steps to start using Prendio Payments?

During the onboarding process, a specialist will review the payments feature with your company and can be enabled by the Prendio Support team. Companies that have completed the onboarding process, but are interested in using Payments can contact Prendio Support by completing the Support Ticket Request Form

After the feature is enabled for a company instance, a user with the AP Management role must complete the following areas in Prendio:

- Initiate & Complete the Application (Account Activated by Payment Partner. See details below regarding documentation required from the Payment Partner.)

- Setup Bank Account in Prendio

- Configure Payment Approval Rules

- Submit and Approve Payment Batches

- Funds are distributed to the suppliers.

What information do I need to complete the application?

After completing the Application Setup details in Prendio, the information provided will be sent to the payment provider and is waiting to be approved:

The user will receive contract information at the provided email. This must be reviewed and signed, and documents must be provided to finalize the setup with the payment partner. The application must be submitted and approved before bank accounts can be added to process payments. Documents required by the payment partner include:

- Articles of Incorporation

- Certificate of Good Standing

- Percent of Ownership

- Authorized Signers and Control Person(s)

- Driver’s License for Authorized Singers / Control People

- USPS Address Validation (South Bedford vs. S. Bedford)

- NAICS Number

Once all of the signed documents have been submitted, the payment partner will review the application. This process can take up to 48 hours. After an application is approved, users can proceed with adding a bank account

What information do I need to add a bank account in Prendio?

Users can add one or multiple bank accounts in Prendio after an application is approved. The following details are required for a bank account:

- Tax ID

- Account Number

- Routing Number

- Bank Fraction (What is a Bank Fraction?)

- Starting Check Number

- Check Signature

Users must also select the GL Account where payments will post to in an ERP system:

After a bank account is added and saved, the status of the bank account will update to Pending for verification. Please note that the verification of a bank account can take up to 72 hours. Once verified, the bank account status updates to Active.

For additional details regarding application and bank account setup, please visit: Payments - Application & Setup

Payments Setup Questions

How is access to the payment’s functionality controlled in Prendio?

Prendio access is role-based, and the payment functionality is broken up into the following sub-roles of AP Management:

-

-

- Payer: Responsible for creating and submitting the batches for approval

- Payment Approver: Responsible for approving the batches before they are routed to the payment partner for processing.

- Payment Setup: Responsible for initiating the application process, adding bank account(s), and configuring the approval rules for payment batches.

-

Do I need to have AP Management access to use the payments functionality?

Yes, the AP Management role is required in combination with one of the three payment specific sub-roles referenced above.

How do I modify payment approvers or create a new approval path?

Anyone with the Payment Setup role can adjust payment approval rules as needed. If you do not have this access, contact a user at the company with the Admin role.

For additional details regarding application and bank account setup, please visit: Payments - Application & Setup Assigning Roles

Payment Questions

How are the payments funded?

Payments are funded via the configured bank account(s) within Prendio. At the time of batch creation, the funding bank account can be selected if it differs from the primary account.

What is the timing of payments processed via Prendio?

Accounts will be debited, via ACH, for the payment batch the next business day following a payment run.

-

-

- ACH & Virtual Credit Card (VCC) payments will be distributed to suppliers following a two-business day holding period to ensure the debit is successful and not reversed according to banking rules.

- Suppliers are expected to receive the payment 3-5 business days after the cut-off.

- Checks are created and mailed the following business day.

- Timing for the check delivery will be impacted by USPS delivery times. Please budget 7 days for check delivery although actual delivery times may be longer or shorter.

- Timing for the check delivery will be impacted by USPS delivery times. Please budget 7 days for check delivery although actual delivery times may be longer or shorter.

- ACH & Virtual Credit Card (VCC) payments will be distributed to suppliers following a two-business day holding period to ensure the debit is successful and not reversed according to banking rules.

-

- Checks: 4:00pm EST

- ACH & Virtual Cards: 6:00pm EST

- If payments are approved after the cutoff times they will be processed the next business day.

How can I use Prendio to pay invoices that I do not have a purchase order for?

Prendio supports Non-PO Backed Invoices. After completing the details and pushing the invoice to the ERP system, a payment batch can be generated from these invoices.

Supplier Questions

Do suppliers receive remittance e-mails for payments?

Yes, suppliers will receive a remittance e-mail for each payment processed through Prendio. This will include the method of payment and details of the invoices and credit memos that make up the payment. A sample of this remittance e-mail is below:

How will my Suppliers be paid? How is the supplier payment information managed?

Our payment partner reaches out to each supplier a company uses to inquire about payment preference. The payment partner will send a registration email to these suppliers to choose their own preferred payment method (e.g. ACH, VCC, or check). Most Suppliers prefer digital, non-check payments. If a supplier does not respond, a check will be sent to the supplier's remit address for payment.

Dedicated Supplier facing teams ensure that your payment is sent to the Supplier in the manner they most prefer.

Can I see if a supplier has responded to the payment partner's registration request and view their preferred payment method?

Clients cannot view whether a supplier has responded to a registration request to indicate a preferred payment method. We have noted this as a potential enhancement for the future.

Is it possible to have the registration email resent to a supplier or have the registration email sent to a different email address?

Yes, our support team can resend a registration email to these vendors on your behalf. Please contact us by completing a Support Ticket Request Form

Payment Reporting Questions

Where can I view payment status for a paid bill? Is this status updated real time?

You can view payment status directly within Prendio as the status is updated in real time and synced to your ERP.

What are the most used payment reports? Where can I find them?

- We have a report of all Payments issued via Prendio available via AP Management > Reports > Payments Report. For additional details regarding access to the report and content, please visit: Payments Report

- Additionally, the Payment Details page can be exported by navigating to AP Management > Payment Details > Generate Payments Report

-

- All existing reporting like AP Order Analysis and Paid Bills reports will automatically incorporate the payment information from Prendio

Virtual Credit Cards (VCC)

What is a VCC payment?

Suppliers can choose two forms of electronic payment – ACH or VCC. Many Suppliers prefer card payment for speed and the security of a one-time use card without having to share banking information or go through account validation activities.

How do you keep VCC payments secure?

VCC payments are made through single use virtual credit cards. These cards come with MasterCard and Visa fraud protection and cannot be used for payment beyond the total bill amount. VCC payments are the fastest and most secure way for many Supplier payments.

Do the virtual cards sent to suppliers expire?

Yes, they expire after 90 days.

ACH

What is an ACH payment?

ACH (Automated Clearing House) is an electronic payment network that directs money from one bank account to another through a secure, and federally regulated, financial system. ACH payments are less expensive, and error prone compared to paper checks.

While the term ACH may be less familiar, it is commonly used for salary direct deposit, social security benefits, tax refunds, and many other uses.

How do you keep ACH secure?

The ACH network is overseen by the US Federal Reserve and other regulated bodies. Additionally, Prendio does not share your bank account information with suppliers – for ACH or any other payment method.

Can I add the ACH details on behalf of a supplier?

Yes! Users can add the ACH details for a supplier for payments to be delivered directly to their bank account. Please note, this feature is currently available for domestics suppliers only. For more details, please visit: Payments - Adding the Payment Method Details for a Supplier

Can I Void a Payment?

The ability to void a payment will depend on the payment method made to a supplier:

Checks - Since checks are written directly on the account, clients can call their bank to issue a stop payment to these checks.

ACH - Payments made via ACH will be difficult to cancel as there’s not a way for our payment partner to stop ACH payments. Clients will need to work with the supplier and potentially have the supplier issue a credit to process in Prendio.

Virtual Credit Cards - For any virtual cards, clients will have an option to cancel by locating the correct invoice and opening the Payment Detailed View window.

Start in AP Management > Payment Details

Locate the correct invoice and select View in the Actions column to open the Payment Detailed View window:

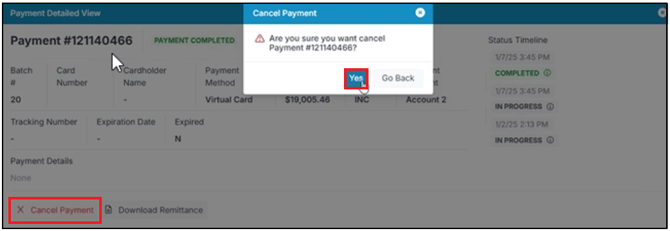

Select Cancel Payment on the bottom left of the Payment Detailed View window followed by Yes to confirm the cancellation:

Please note that if attempting to void a check or ACH payment, clients will need to reach out to the bank or supplier outside of Prendio. If this process is successful, the invoice must be reverted from Paid Bills and void the payment record in the ERP system. For additional details on reverting a bill, please visit Backing Out of the Receipt When a Voucher is in Unpaid, Pushed, or Paid Bills

Support & Contact Information

Who do I contact for more information regarding payments in Prendio?

Clients currently utilizing the payments feature with questions about the application, process, Prendio invoicing, along with new clients interested in having payments enabled, please complete the Support Ticket Request Form for a member of the Prendio Support Team to contact you.